how to get t1 general from cra website

Save time and put it back in your business. Your 9-digit CRA business number.

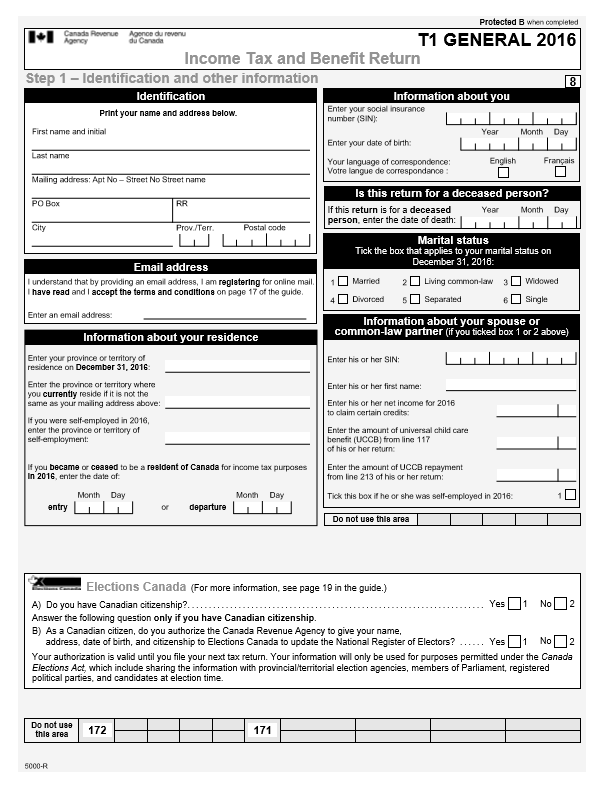

T1 General Mackenzie Gartside Associates

Sell or make a gift of cryptocurrency.

. Weve Got Your Back. You will get a personal manager and a discount. This is the main menu page for the T1 General income tax and benefit package for 2021. The Canada Revenue Agency CRA.

Spending your time watching hot Indian sex videos on hindipornvideosinfo is the best way to enjoy yourself. GET MORE INTERVIEWS. Sometimes it takes a while. You can also login to My Account through the Canada Revenue Agency website to access an online copy.

New employers must first open a payroll program account in order to remit deductions to the CRA. Anything older you will need to contact the CRA directly at 1-800-959-8281 to request a copy. In general users need to report a transaction on their Canadian personal income tax return when they dispose of cryptocurrency. These videos will most definitely be.

The tax year runs from 1 January to 31 December. This means instead of paying a subscription fee and getting just a dozen or so videos you get free tube porn without having to deal with the problems that come with limited selection and expensive memberships. We would like to show you a description here but the site wont allow us. Match resume to employer job description.

Well send you the first draft for approval by at. You can find the payroll deductions tables by province on the CRA website. Each package includes the guide the return and related schedules and the provincial information. On the website of CRA disposition of cryptocurrency means as follows.

Next the employer will have to ask the employee to provide his or her social insurance number and complete Form TD1Personal Tax. The Canada Revenue Agency CRA is responsible for collecting taxes in Canada. You can reduce the amount of business income that you earned because the CRA allows the. We can help you reach your academic goals hassle-free.

The following are the federal tax rates for. 1-866-374-1129 1-866-374-1129 or 416 977-4425 416 977-4425 Monday Saturday 8 am. 2019 Income Tax Package. 2017 General Income Tax and Benefit.

Agence du revenu du Canada. See How Your Resume Match to Job Openings. T1 returns can only be mailed to the addresses specified here. You can find a copy of your submitted T1 General if you have registered for a CRA My Account.

Your NOA can be found under the tax returns tab. The T2125 is sent to the CRA along with your other tax forms which make up your T1 General return. Power up Your Study Success with Experts Weve. Trade or exchange cryptocurrency including disposing of one cryptocurrency to get another cryptocurrency.

Order Form - 2021 Order Form - 2020 Order Form - 2019 Order Form - 2018 Order Form - 2017. If you own your unincorporated business with a partner or partners the same T2125 is filled out however there is some additional information relating to the partners which is required and TurboTax Self-Employed takes care of that too. 2021 Income Tax Package. We can help you reach your academic goals hassle-free.

A T1 General is your tax return. There are many reasons why you would need to contact the CRA for example filing taxes disclosing a mistake reporting spam resolving GSTHST issues and having general tax and business inquiries. The CRA collects taxes administers tax law and policy and delivers benefit programs and tax credits. We do not at any time disclose clients personal information or credentials to third parties.

2018 Income Tax Package. The good news is that filing as self-employed is not complicated. If on the other hand you have. We give anonymity and confidentiality a first priority when it comes to dealing with clients personal information.

Steps for new employers. RRSP withdrawal amounts are added to your gross earned income. If you used TurboTax to file your taxes. Legislation administered by the CRA includes the Income Tax Act parts of the Excise Tax Act.

All residents and those who need to pay tax have to fill in a self-assessment tax return. Individuals can select the link for their place of residence as of December 31 2021 to get the forms and information needed to file a General income tax and benefit return for 2021. You must declare this amount on your T1 General Income Tax Return in the calendar year you withdrew it. Depending on the size of the withdrawal it could push you into a higher tax bracket.

The following are some of the ways we employ to ensure customer confidentiality. The applicable T1 T2 T2 Short or T4 summary used in your application. You can find that information on your T1 Income Tax and Benefit Return or your notice of assessment. As a general rule to calculate income for child support you must identify the updated amounts related to the sources of income used to calculate your Total income on line 15000 150 for 2018 and prior years of the T1 General Form issued by the Canada Revenue Agency.

2020 Income Tax Package. We also reminded the CRA that other significant deadlines are approaching on June 15 for T1s for the self-employed and spousespartners. The deadline for tax returns and tax payments is 30 April the year after the tax year. For any general program related questions you may visit the CEBA website at httpsceba-cuecca or contact the CEBA Call Centre.

Power up Your Academic Success with the Team of Professionals. Self-employed workers have an extended deadline of 15 June. Check My Resume Match See demo. T183 AuthRep Consent T2091 T1134 T1135 T106 T183CP RC71 RC72 and T1032 Pension Splitting with signatures of both spouses.

The person who submits your tax return should. Federal Tax Rates. Help your resume rank and score higher. Please note that the information available on this website is the same information available through the CEBA Call Centre.

Downloads current Demos. General FAQ Analysis and research B Corp. The Canada Revenue Agency. For more general customer service questions you can call the provider at.

All thats required is the reporting of your self-employed or business income on form T2125 the Statement of Business or Professional Activities in addition to the reporting of your income on your T1 General. We asked the CRA to keep in mind that many incomplete T1 returns may have been filed since no extension was allowed and that it should expect that it will take more time to finalize these returns through T1 adjustments. Tax packages for all years. Automatic electronic signature on T183 and other T1 and T2 forms on which CRA requires them ie.

Pass application tracking system screen. By using our website you can be sure to have your personal information secured. CRA Conflict Resolution Advisory CRDA Converging Runway Display Aid CRT Cathode Ray Tube CSA Communications Service Authorization CSIS Centralized Storm Information System CSO Customer Service Office CSR Communications Service Request CSS Central Site System CTA Controlled Time of Arrival CTAFIR Control AreaFlight Information. Each package includes the guide the return related schedules and the provincial or territorial schedules information and forms except Quebec.

Your account should have the records of T1 General for the current year and the past 11 years that you filed under the tax returns view section. ARC is the revenue service of the federal government and most provincial and territorial governments. It is generally at least 4 pages long and you must ensure you submit all pages to your Broker when it is requested.

Cra Proof Of Income Statement Mackenzie Gartside Associates

Fillable Online Cra Arc Gc T1 General 2012 Non Residents Form Fax Email Print Pdffiller

Need Your T1 General Tax Form Best Regina Mortgage Advice

What S The Difference Between An Noa T4 And T1 General

How To Set Up My Account For Individuals With Cra Red Seal Financial Ltd

Post a Comment for "how to get t1 general from cra website"